Take advantage of

the IRA Triple Play

Limited time onlyEarn an uncapped 1% match on IRA rollovers and transfers. Plus, earn 1% on your annual contributions.

Earn 1% three different ways

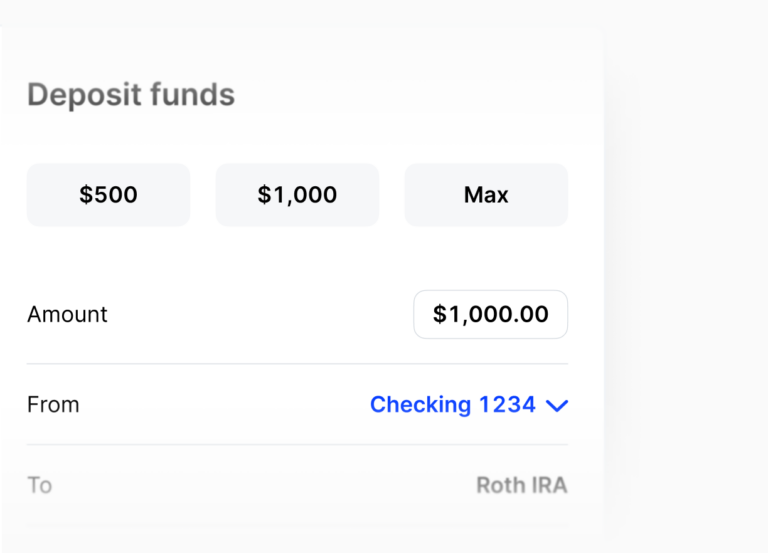

Earn 1% on annual contributions

You can earn a 1% match on your annual IRA contributions. That’s extra income each year that won't count toward your IRS contribution limit.

Earn 1% on every 401(k) rollover

Our partnership with Capitalize makes it easy to roll over your old 401(k)s to an IRA on Public. And now, you’ll earn a 1% match in the process.

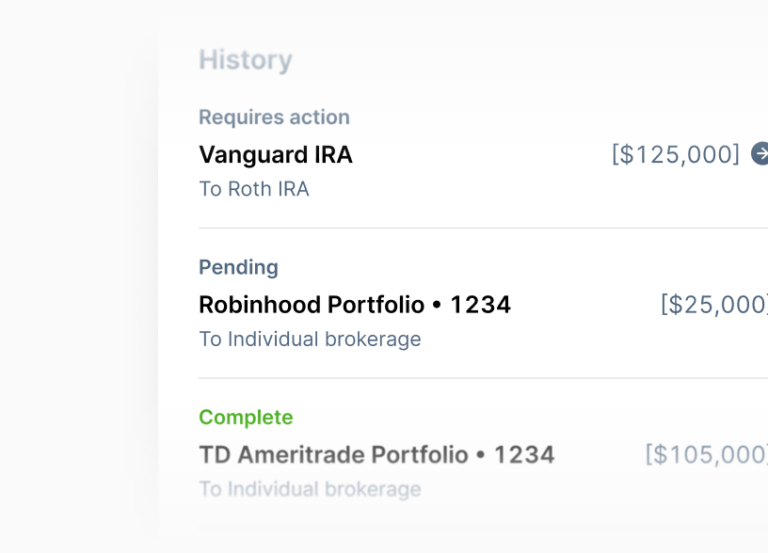

Earn 1% on every IRA transfer

Have an IRA with another brokerage? When you transfer it to Public, you'll earn a 1% match on the full balance. We’ll even cover any transfer fees.

Invest for the retirement you want

-

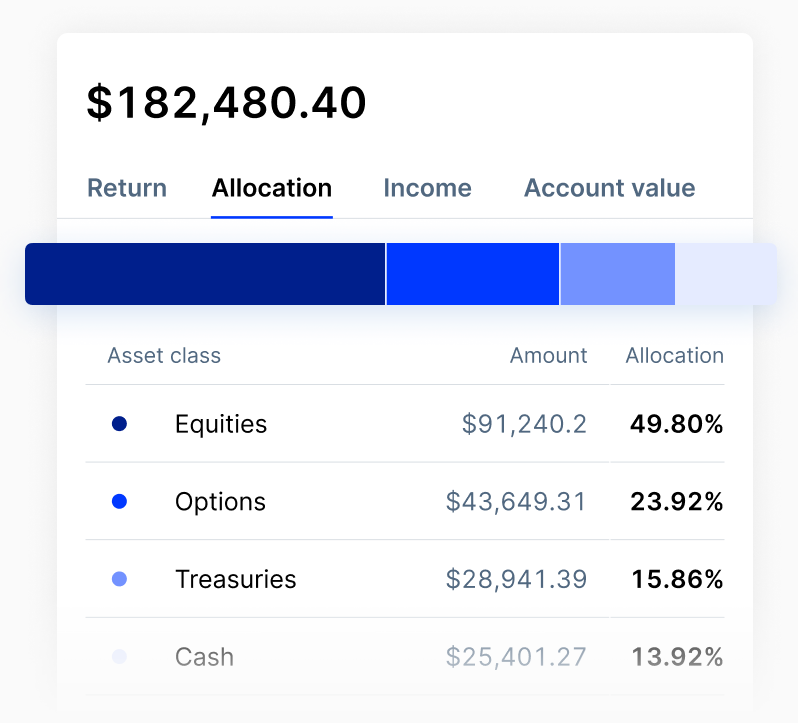

Stocks, ETFs, and bonds

With a self-directed IRA on Public, you can access thousands of stocks, ETFs, and bonds to align your investing style with your retirement goals.

-

Options trading

On Public, you can trade options in your IRA—a feature many brokerages don't offer. Plus, you can earn rebates on your stock and ETF options trades.

-

Investment Plans

Prefer to set it and forget it? You can schedule recurring contributions to a pre-made Investment Plan—or build your own with up to 20 assets.

Max out your IRA. Stress-free.

With an IRA on Public, you can set up recurring investments that stop once you hit the IRS limit, so you never have to worry about over-contributing.

*It is the customer’s responsibility to verify contributions they may have made at other institutions

Program your trading in your IRA

With our free-to-use API, you can program trades, automate your strategy, and earn rebates on stock and ETF options contracts—all within your IRA.

Request Access

See the power of compounding at work

Calculate how regular IRA contributions can transform your retirement savings over time.

The chart estimates how your savings could grow based on your specified interest rate and compounding schedule. It is for illustrative purposes only, not a guarantee of future results, and losses are possible. This is not tax or investment advice—consult your tax advisor for personalized advice. Visit see the IRS website for details on Traditional and Roth IRA limits and benefits. All investments involve risk.

How do I use this compound interest calculator?

-

Current retirement savings: Enter the total amount you've already saved for retirement, including any existing IRAs and 401(k) accounts.

-

Annual contribution: In 2025, the maximum contribution you can make to an IRA is $7,000.

-

When do you plan to retire: Enter the number of years from now when you expect to retire.

-

Average rate of return: Enter your expected investment return rate. The returns you can expect from your IRA depend on the investments you choose.

-

Compound frequency: Choose how often your returns are compounded (e.g., yearly, quarterly, monthly).

Get built-in protections from SIPC

Our broker-dealer is a member of SIPC, which protects up to $500,000 of the securities in your accounts, including $250,000 in claims for cash.

Have questions? Find answers.

What is the IRA match and how does it work?

When you open an IRA on Public, you can earn a 1% match on your annual contributions. Plus, Your IRA match is considered interest income, not a contribution—so it won’t count toward your IRS limit. That means you can earn up to an extra $70 or $80 if you max out your annual contributions.*

*As part of the IRA Contribution Match Program, Public Investing will fund a 1% match of all eligible contributions made to a Public IRA up to the account’s annual contribution limit. The matched funds must be kept in the account for at least 5 years to avoid an early removal fee. Match rate and other terms of the Match Program are subject to change at any time. See full terms here.

What’s the difference between a Traditional and a Roth IRA?

Traditional and Roth IRAs are two types of tax-advantaged retirement accounts. With a Traditional IRA, you contribute pre-tax income and pay taxes when you withdraw in retirement. With a Roth IRA, you contribute after-tax income, but your withdrawals are tax-free—so long as you meet certain conditions.**

**The tax treatment of IRA contributions and withdrawals is subject to meeting certain IRS requirements. Please see the IRS website for more information to determine which type of IRA makes sense for you.

Can I roll over or transfer my existing retirement account?

If you roll over a 401(k) or transfer an existing retirement account to Public, you can earn a bonus of up to $10,000. Plus, we don’t charge fees for incoming transfers. If your current brokerage charges you on the way out, we’ll cover up to $100 in transfer fees, provided your account value exceeds $5,000.***

***Fees covered for transfers over $1,000, up to $100 per transfer. Additional terms apply.

What kind of investment options are available in an IRA?

With a self-directed IRA on Public, you can access thousands of stocks, ETFs, and bonds to align your investing style with your retirement goals. You can even trade options in your IRA—a feature many brokerages don’t offer. Plus, you can earn rebates on your stock and ETF options trades.****

****Options trading entails significant risk and is not appropriate for all investors. Review Options Disclosure Document here. Review Options Rebate Terms here.

What are the IRA contribution limits for 2024 and 2025?

For 2024, the IRA contribution limits are $7,000 if you’re under age 50 and $8,000 if you’re 50 or older. You can make contributions for the 2024 tax year up until the unextended federal tax filing deadline based on income earned in 2024. The IRA contribution limits for 2025 are the same as 2024.**

**The tax treatment of IRA contributions and withdrawals is subject to meeting certain IRS requirements. Please see the IRS website for more information to determine which type of IRA makes sense for you.

What’s the IRA contribution deadline?

You have until the federal tax filing deadline to make IRA contributions for the prior year. For 2024, that means you can contribute up until April 15, 2025. Want to get ahead on your IRA contributions for 2025? You can start contributing as early as January 1, 2025, with a deadline of April 15, 2026.**

**The tax treatment of IRA contributions and withdrawals is subject to meeting certain IRS requirements. Please see the IRS website for more information to determine which type of IRA makes sense for you.

Fund your account in

5 minutes or less