Options Foundations

Loss Potential

Understanding "loss potential" is crucial for investors, especially in options trading. It refers to the potential amount one could lose in a strategy, a key factor in making informed investment decisions and managing risk effectively.

Basis of loss potential

The basis of loss potential is the core measurement of risk in options trading. While the allure of gains is enticing, recognizing what's at stake is equally important, emphasizing the need to evaluate and manage potential losses in trading strategies.

Common perception of loss

Many assume that the maximum loss in options trading is limited to the premium paid for the option contract. While true for certain scenarios, it's crucial to acknowledge that this perception doesn't hold in all cases, highlighting the importance of a nuanced understanding of potential losses for each options strategy.

Fundamental strategies

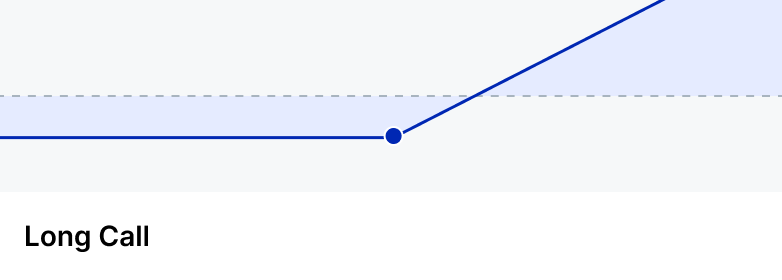

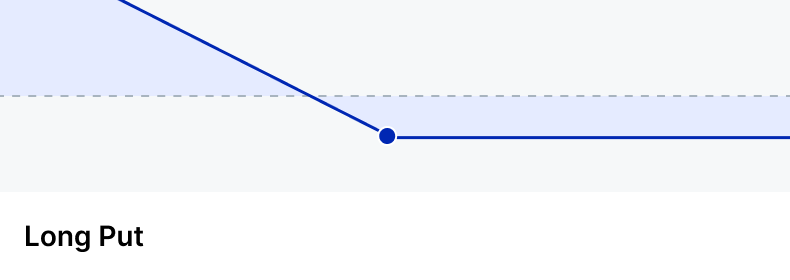

The two most fundamental strategies - long calls and long puts - have capped loss potential. In both strategies, the maximum loss potential is the premium paid for the option itself.

Scenarios of unlimited loss

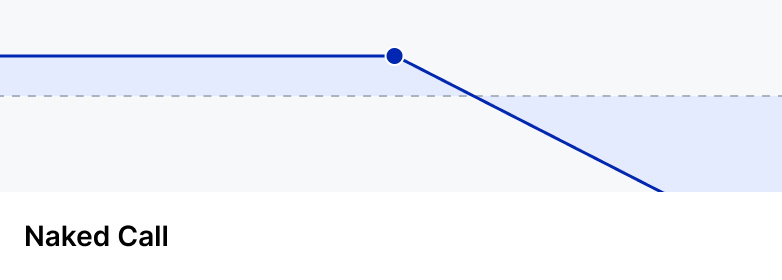

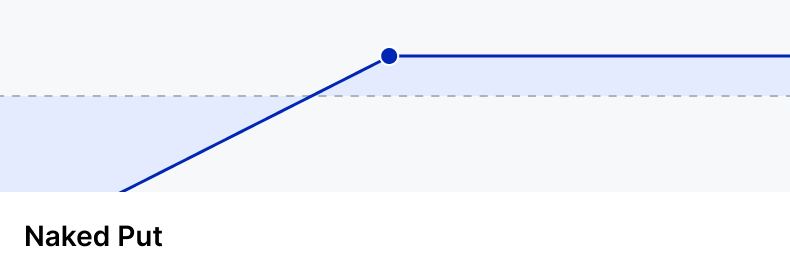

Some other options strategies, like naked calls and puts or short straddles and strangles, pose the risk of unlimited losses. This risk arises from commitments to fixed prices, unpredictable market movements, and the absence of caps on option prices. Caution is advised, and alternative strategies with capped losses are recommended.

A Naked Call or Put is when either a call or put option is sold by itself (uncovered) without any offsetting positions.

A Naked Call or Put is when either a call or put option is sold by itself (uncovered) without any offsetting positions.

Options levels

Most brokerages use Options Levels to help investors understand the complexity and risks of different options strategies, and protect investors from engaging in risky strategies that do not align with their stated investment objectives and/or experience levels. Level 4 strategies are categorized by those with unlimited loss, while Level 2 strategies are those where the loss is capped to the premium paid.

Importance of understanding risk

Understanding risk is paramount in options trading. Tools like profit and loss charts provide visual clarity on potential outcomes before entering a strategy. You can find these tools on Public to help you understand the potential risks and rewards.

Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

Options resource center

Options Foundations

Chapter 1Options 101

Chapter 1Options 101 Chapter 2P/L charts

Chapter 2P/L charts Chapter 3Time value

Chapter 3Time value Chapter 4The greeks

Chapter 4The greeks Chapter 5Exercise and expiration

Chapter 5Exercise and expiration Chapter 6Assignment

Chapter 6Assignment Chapter 7Loss potential

Chapter 7Loss potential Chapter 8Options trading rebate

Chapter 8Options trading rebateFundamentals

Multi-leg Strategies